Utilizing Support and Resistance Levels

Part 2 of 4: Applying trend lines and channel analysis to identify support and resistance levels.

By Toni Hansen

Today's topic is an expansion upon the previous segment where I introduced you to the basics of support and resistance levels. In the last class I talked about the various types of price support and resistance. These included whole numbers, previous highs and lows, congestion zones, and equal move or measured move levels. Gap zones also fall into this category.Today's topic deals with a more difficult type of support/resistance level to identify: trend lines and trend channels, as well as how to use them in your trading. I will begin with a very brief review of what exactly support/resistance levels are and how to approach them. Support refers to prices under current levels, while resistance refers to prices above. Essentially, they are price areas where a security is likely to have some sort of reaction to that price area. The key word here is "area," or "zone" is another word that could be used. Support/resistance levels are NOT exact prices, even if you may think they should be! Even $100 is not an exact resistance price if a security is moving higher into it. Rather, it is the zone around that price, which can be wide if the volatility is high and momentum is strong heading into it, or can be rather narrow if volume is low and the momentum or pace of a move into the resistance is gradual.

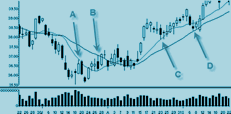

From last week you may recall that we looked at a specific type of price support/resistance whereby we looked at previous highs and lows as support/resistance levels. Today's class builds upon that concept. A quick review of it is shown with this example in Figure 1 of the ES from the last couple of trading days. The ES has been in what is called a "trading range" or "congestion zone" during the past 4 sessions. This means that most of the prices fell within a given price range. On the 17th, the day began with a narrow range. #4 and #5 marked the lower end of that range. #4 was support, which held when tested a second time.

FIGURE 1 - ES 15 MINUTE

The third test of a support or resistance level is often the one most likely to break. The ES did so early on in the afternoon. Once support breaks, when it's tested again, such as at D and then E, it becomes resistance. This concept is repeated on a larger scale with A, B, and C as highs and 1, 2, and 3 as lows. If you were watching the market into the close, you will notice that the ES tested that upper channel resistance again afterhours, making this the third test after the move higher from mid-day on the 18th. (Update: It then broke higher later in afterhours trading and opening with a significant upside gap into the next session.)

The idea of trend lines and trend channels takes the basic idea of previous highs and lows as support/resistance levels and turns it on edge. So, instead of the sideways trading range with obvious highs and lows, we now are beginning to look at other types of trends using the same principals.

The sideways trend is just one of the three major trends in a market. A trend is simply the direction of price movement. An uptrend is a series of higher highs, while a downtrend is a series of lower lows. The sideways trend is more of a choppy range with highs and lows at comparable levels, although often they will favor one end of that range over the other, much as they did o the morning of the 17th in the ES in the first example, where they favored the lows.

FIGURE 2 - UPTREND CHANNEL

Figure 2 displays a typical uptrend. The blue lines connecting the high points and the low points are the trend lines. Combined, they make up the trend channel. Now, to form a trend line, you simply need two points of reference to go off of. In the sideways trend we only needed one: the previous high or low. In a directional trend, such as an uptrend, we need two highs with the second higher than the first. In this image those points are A and B. Before any lows following B are even made, we can go ahead and connect those two upper price levels and extend the line connecting them outwards. This becomes the trend line resistance levels. As it is tested on a subsequent move higher, the zone around that line serves as a level where prices are likely to react in some manner to that resistance zone.

Keep in mind what we talked about last time: The faster a resistance level hits, the more "give" it has to it. So, if the momentum off the low from #2 is faster than off the low from #1, then it can push through that upper trend line's exact price level a bit more before bouncing back in.

When the prices in this chart returned to the lower channel at #3, they did not make it back to the upper level again. Instead they only moved up about halfway or a bit more before dropping through the lower trend channel. Now, at this point, that lower trend channel support has broken and becomes resistance on any move or push higher. This is the case of where it is tested in D. If you miss out on the first or even second entry trigger when playing reversal patterns, then "D" becomes a good level to pick up a short position. Often I do not even wait for a smaller trend channel to form and break, but will enter the short as soon as I see any stalling within that move into D.

FIGURE 3 - RIMM 50 TICK

Obviously, as with any tool for reading the market, the support and resistance zones are just one factor in a larger picture. Figure 3 shows a great example from this afternoon where the trend channel support/resistance action in play. The initial trend channel can be drawn by connecting A to B and then extending that line downward and then connecting 1 to 2 and doing the same.

Notice that the selling increased with each downside move. This pushed the prices into that lower trend channel more than if the prices had declined at a similar rate as before. Hence, the support had more "give" to it. After bouncing back, the channel held again at D, forming a smaller and slower drop around 15:20 ET. The door was now open for a confirmation of the trend change.

FIGURE 4 - RIMM 50 TICK

Another example soon followed in Figure 4. What I want you to pay attention to here is that when RIMM tested the upper trend channel at C, it did not immediately pull back off that level. Although earlier it had pulled off it gradually in D in Figure 3, this time it hugged it. Both of these are variations on the same thing: momentum change. By hugging the resistance level or pulling off it very slowly, it creates the scenario for that resistance level to break. Now, in this second example it attempted to do so too quickly, and hence congested longer, however the theory is still the same.

Another example of the channels is found in GOOG from today in Figure 5. The channeling action in GOOG was a primary contributor to it being the main focus of my attention this afternoon. In GOOG we had a series of channels forming and breaking, each more bullish than the next.

FIGURE 5 - GOOG 50 TICK

The first channel began right away out of the open. It was a slow downtrend into 10:00 ET. GOOG did not hit the exact price of the upper trend line at B, but it did come into that price zone. It then did not make it back to the lower end of the channel, instead stalling about halfway to where the lower channel line would be and rounded off. The stock returned to the upper channel, but again only held it a few minutes before breaking through. This trend break alone was not enough on the larger time frames to yet sustain an upside move. As the day progressed, however, the channel did as well.

As a channel develops, the last segment of the channel often gains importance over the first. So, the result is that I am often changing my trend line to adapt. Drawing trend lines is more of an art than an exact science, which endlessly frustrates those traders trying to devise programs to display them automatically. Often I leave out extreme ticks when I am looking at a trend line, or I pay the greatest regard to the bodies of a candlestick chart and look for my trends to closely associate with them.

FIGURE 6 - GOOG 50 TICK

Figure 6 shows the progression of the trend channel out of the open in GOOG. "B" had not quite touched the upper channel line, so I drew a new one to project out the upcoming support levels. Notice that the move into 10:15 ET corresponded to the previous low, which is another major type of support level. Of course the time of the day also factors in. In terms of the channel, however, that resistance from the trend channel on the upper end of it, when extended, quickly became the support only 15 minutes after it had broken.

FIGURE 7 - GOOG 1 MINUTE

Figure 7 takes this channel out further and looks at the larger channel of the formation this morning. #1 is the support level we were just looking at. It held and a higher high was made, but still under the initial morning lows. By pulling back again into 11:00 ET, it formed a second low to create a symmetrical triangle. At that point, once the prices began to move higher at about 11:15 ET, the highs from A and B could be linked and extended, as could the lows from 1 and 2. Notice that as GOOG moved higher into 11:30 ET, when it hit that upper channel, it hugged it throughout the majority of that mid-day correction into noon off that high. This continued to develop the bullish bias in the stock into the early afternoon.

Again, when looking at the last segment of that trend channel, it became support once broken over noon, holding on lows around 12:30 ET and into 13:00 ET. This can be seen in Figure 8.

FIGURE 8 - GOOG 1 MINUTE

With each pullback into the afternoon, the trend channel shifted. The first drop in the morning was the strongest, followed by a symmetrical triangle and then an ascending triangle, which is displayed below in Figure 9. At "D", GOOG had pulled up through the upper channel line. It is the pullback off that channel break that gave us the trigger for a buy off my post, creating a setup into 13:30 ET. It could have been taken off 13:00 or 13:15 on those smaller channel breaks had I seen it in time, but the one into 13:30 was a complete break of the entire day's channeling action.

FIGURE 9 - GOOG 1 MINUTE

Once a channel breaks, momentum often changes. This is shown in Figure 10. At this point, you have to switch to larger trends for identifying upcoming resistance levels in the cases of moves higher and rely on the other technical tools in your arsenal to assist you.

FIGURE 10 - GOOG 50 TICK

Figure 11 shows the channel accelerating. We put a target on it of $690 due to the whole number resistance with the 10s in GOOG. This was also equal move resistance and price resistance from about a week ago. So, while the trend channels and trend lines are something that can be highly beneficial, never rely purely on one type of support or resistance. The more types there are coming together and the more attributes there are coming from other technical tools to combine with it, the better.

FIGURE 11 - GOOG 50 TICK

Thank you for coming!The room is now open for any questions.

Helena1045: I notice you used a 50 tick chart for RIMM and GOOG and mentioned an 800 tick chart in the room for ES. How do you decide what number of ticks is appropriate and when it is better than a timed chart.

Toni: With securities it can be a bit of trial and error. You want it to be a size whereby you can see the waves of buying and selling and make out the trends. I use three monitors and have all kinds of time frames up. If you cannot make out solid trend moves then you are too small or if prices are just flying and your chart is moving too fast then back up some. I use the 25 and 50 tick charts for timing, but the 100-800 for the actual larger setups. Although I admit I will scalp a setup on them if they happen to stand out.

Helena1045: Ahh! Thanks.

ajay: do you scalp of those channel boundaries yourself?

Toni: Sure do when they are combined with the other technical tools I use. http://www.swingtrader.net/ They are laid out in great detail in this course... :)

brucem: what times of day do you look at for trend changes

Toni: The reversal periods fall at 15 and 45 min past the hour in the morning and then shift to on the hour and half past in the afternoon. 12:00 and 14:00 are big ones. Eastern that is.

cszanto_: How can you filter the securities?

Toni: I use very basic scans: Percentage and price gainer and losers, near 52 week highs, and gappers.

cszanto_: ok, thx

unocapricorn: when drawing a trendline I've heard that on the starting candle you start at the top and that includes shadows. Is that correct?

Toni: This is where the art of it comes into play..... If the shadow is an extreme tick and most of the prices weren't actually trading there then I ignore it Otherwise, I use the shadow.

unocapricorn: thanks

Toni: If a trend is very choppy and there are a lot of extreme ticks focus on the bodies of the trend and make a trend channel that is a channel meaning Connect the highs of the majority of the bodies for the upper channel with one line and then connect the highs of the tails so then you know that as price come back up into that zone that it is resistance.

cszanto_: do you use MA's?

Toni: That is our next class :)

cszanto_: :)

Toni: January 3, 2007 4:15 ET Utilizing Support and Resistance Levels - Part 3 Applying moving averages for identifying support and resistance levels. January 17, 2007 4:15 ET Utilizing Support and Resistance Levels - Part 4 Applying Fibonacci levels to identify support and resistance levels (focus on EMini trading).

Mainstreet: what do you use as momentum indicator(s)? ty

Toni: nothing

Toni: my eyes :)

Mainstreet: :-)

unocapricorn: what is stronger for support and resistance levels : moving avgs or fib retrcmts levels?

Toni: Hmmm... It really depends on the nature of the trend at play. Fibs work best in choppy markets ranges etc Whereas the moving averages then work better on directional trends

Ed: i've heard people say the the futures markets will lead the stock market on intraday basis how does it work, and what kind of futures do we look at?

Toni: I think that if you look at stocks that are heavily weighed in one of the indices that this can work, but I have not found it to be worth my time to attempt to focus on. I do prefer setups in stocks that are favoring moves in the same direction of the overall market though if this is what you mean. I will use the futures to give me a larger picture of what the most likely price action for the day will be... such as this afternoon the market was biased higher, so I focused upon a security which would take advantage of that. There are many securities I would trade that may not directly be influenced by larger market activity. I trade a lot of news-related moves in securities and they can move higher easily even as the market falls. Although often entry and exit triggers will correspond to major index reversals or support resistance levels. I have noticed that a lot of the time as I am playing AAPL that the market will hit a support level something to turn it higher and I will take my position in AAPL based upon that before it confirms on AAPL itself and do the same with other securities that are heavy in the indices, but I do not really study it per se.

zlev: what are your favorite stock ?

Toni: This changes over time. Favorites lately are JASO, BIDU, BIIB, ISRG NOV and ESLR. those come up for me a lot. I have some I hate and won't touch.... DELL and ICE and HANS :)

unocapricorn: could you please clarify for me the difference between the main and secondary trends? Is the second trend steeper?

Toni: primary and secondary trends are dealing with the fractal nature of trends... meaning that each trend is comprised of smaller trends For instance, if a security is heading higher the pullbacks would be smaller (or secondary) trends to the downside. whereas the upside move as a whole is the primary trend. or "main" trend :)

zlev: thank You for excellent session !

Ed: yes, thank you

Helena1045: Yes, enjoyed the session! Thanks much!

Toni: You are welcome :)

unocapricorn: thanks , happy holidays

Toni: u too!

billgi: ty toni..appreciate it

Millowena: Thanks, Toni!

Toni: ur welcome mike :)

opw: Thanks for the class T... good night all

Toni: Thank you everyone for making it!

flowercard: ty

Helena1045: Thank you. Good night!

cszanto_: thx

cszanto_: bye

Toni: nite :)

jmb: Thanks Toni

Toni: yw

thomas1751: thanks Toni

RT: is this the same chatroom your Online Trading room is hosted?

Toni: y

Toni: i will be on vacation over the holidays but there will still be lots of regulars in here posting so feel free to drop by if you wish

RT: do you give actual buy sells

Toni: we share what we are watching for buying and selling but there are not alerts and such stocks are posted in purple like GOOG basing at highs

RT: is there any indication to the chat user that you are going to buy/sell

Toni: yes i will post the pattern if applicable and not just a breakout like: APPL avalanche 17:39:23 Avalanche: For more information on this setup, please see http://www.tradingfrommainstreet.com/techanalysis.html#4 which then gives the details on what that is for new people http://www.tradingfrommainstreet.com/techanalysis.html here is the main link for patterns

RT: so those pattern names are the main clues to what buy/sell indications?

Toni: yes bases at highs are buys bases at lows are short anything i post will be pretty obvious and if not, just ask :)

RT: thanks that is what I was trying to determine, if it is just chatting or real trading room for traders

Toni: It is both :) its not a service based room though meaning i am not here to generate calls for people

Big: is there a way to tell if a trade will be a winner or a loser?

Toni: all are winners.. duh

Toni: hehe

Big: good answer!

RT: thanks Toni, I will have to try it myself. Price it right...yes

Big: awesome class thanks !

Toni: :)

Click here to view Part 3.

Testimonials for Toni Hansen

"Dear Toni, I want to thank you for sharing the knowledge and insights you have gained over the years as a professional trader. I would recommend your CD and mentoring to anyone serious about consistently making money in the market, regardless of market conditions. As an experienced investor who has watched you firsthand, it is clear that you are a world class trader. Thanks for helping me become a better trader." - Guy Allen, Florida

“I owe you so much when it comes to my development as a trader. You have been a guiding light... I will always look back on you as a key element in that success. Thank you so very much...” - Greg

“Anyone who is trading needs your guidance for the education of trading. Your education of trading aspects is the GREATEST thing I have ever used. I learned more in two weeks from you, than from any books I read. THANKS AGAIN!” - Clarence E. Austin

“I'm done for the day and am very pleased...I have taken all your calls and follow them to the T...the NQ ones that is (trade QQQQ) and I play the gaps in the morning also (I'll take the 71% chance anytime)...I have turned myself around...First time in months...Thank-you! ”- Richard Widen

“I hope that everyone truly understands just how fundamentally sound and accurate your market trading strategies and concepts are. I have been trading for quite some time, and I just want you to know that I have been so very impressed with your substance based upon sound trading fundamentals and not "fluff" THANK YOU...” - Randall Morrow