Utilizing Support and Resistance Levels

Part 1 of 4: Applying basic price levels to identify support and resistance levels

By Toni Hansen

OK gang... let's let going... First of all... thanks for coming! This is the first of a 4-part lecture series on support and resistance. For those of you who have purchased my CD series, the material in this series is going to be a bit of refresher. It will cover some of the main points in the S/R segment of that course, but I have completely new charts, etc., so it will help possibly clarify some of the points as well. I will take questions following the class, so please hold off until then since often I find that many of the questions people have mid-way end up answered by the time I am done anyway. :)

Simply put, support and resistance levels are places in the market when the current trend or price move that is in play in the market will either turn or stall. The traits of support and resistance levels apply to all type of markets and time frames, so the concepts in this class will figure into any market you trade.

Now, when thinking of support and resistance levels, it is very common for most people to think of them in terms of absolute price levels. For instance, if they are looking at $50 as a resistance levels, they mean exactly $50. On the other hand, if they are looking at moving averages as a support level, they will check to see what the exact price of the moving average is, such as $50.78.

In reality, support and resistance levels are not exact prices, but rather price zones. So, if the resistance level is $50, then it is actually the zone around that $50 level that is the resistance. The stock may hit only $49.87 or it may hit $50.25 and still hold the $50 as price resistance.

The main factor in determining exactly how much the exact prices are tested by is how quickly or slowly the prices move into that resistance zone. For instance, if the zone hits very quickly on a large momentum surge, then it is more likely to hit that $50.25 level. This is also the case if the stock is a rather volatile one with a wide price range intraday. If the security spikes higher and does not quite hit the price resistance, such as a spike into $49.70, then it may round off into $50 with slightly higher highs and never exactly touch the $50 price resistance zone before turning over due to the slowdown in momentum into that resistance. The larger the time frame, the greater the price zone is as well. A resistance zone at $50 on a weekly time frame may have a range of $1 on each side of $50. Where traders tend to run into trouble is in thinking that because the stock has traded over $50 by more than just 10 cents that the $50 has broken, so we often hear of people "buying the highs" or "shorting the lows" in the case of support.

For today's session I am going to focus on 4 main types of price support and resistance. They are WHOLE NUMBER SUPPORT AND RESISTANCE, PRICE PIVOTS, PRICE CONGESTION ZONES, and EQUAL OR MEASURED MOVES. I will begin with the whole number support/resistance (s/r).

Whole number support and resistance refers to the price levels most of us have in our head when we think of support and resistance right away. They are levels like the 14,000 that we have heard so much talk of in recent months. CNBC does not get excited by the Dow hitting 13,984. We do not hear about oil in terms of the cents per barrel, but rather it's proximity to breaking the whole number level. When a security, or the market overall moves into these larger price levels, rounded to either the dollar in most stocks, or the 10s, 100, etc. people tend to react most often at those levels. It's second nature. My third grader has just spent her first semester in school learning how to average and to round up or down. That is then taken with us throughout our lives.

For futures traders a common level we will notice in the NQ is how that tends to gravitate to moves of 5 points at a time and stall at or about the 5 point increments. In the YM the 10 point increments, and particularly the 100 point levels catch people's attention and reversals or consolidations tend to form at those zones. In the chart of the Dow Jones Ind. Average (Figure 1) we can see how it often moves towards those 100 point increments as well. The 12,000 and 14,000 level are the most pronounced in this case, but many of the places it stalls at are almost exactly at a 100 point price level.

Even though at "D" the Dow technically broke 14,000 in terms of the exact price (yet held the 14,200 securely) when we think of the Dow in terms of a larger time frame move, we have yet to see the 14,000 zone penetrated. At 14,200, the Dow was STILL AT the 14,000 price resistance zone. What I am looking for at this point is a third test of that zone, maybe even a slightly higher high and then a larger correction where we can see a stronger reaction to this price resistance zone on a larger time frame.

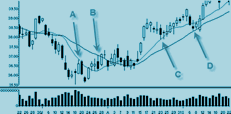

FIGURE 2 - JBLU Daily

Here is another example of price support and resistance (Figure 2). This time it is in a rather cheaply-priced stock that I'm sure you've all heard of... JBLU (JetBlue Airways). At times, the support or resistance zones will appear to break, pushing through the s/r level only to swing back and hug that level. This was the case in March and early April in JBLU. JBLU had fallen into $12 on rapid momentum, pushing it somewhat under the exact price support of $12. It then hugged that level for over a month before giving way to another round of selling into the $10 support zone. Once again the momentum was strong, so it traded slightly under that exact price before pulling highs. When it tested it the second time around, however, in the middle of June, it held that price more precisely since the momentum at that point was not as steep. This second test of $10 was then followed by a retracement back into the $12 level. Once a support zone breaks, such as the $12 level in JBLU, that zone then becomes resistance on a reversal.

FIGURE 3 - PDLI Daily

Here is another example that you can look at which shows similar types of price activity (Figure 3). Notice that the rapid move into November with one bar of selling pushed through the $18 exact price level that first day it it, however, it then sprung back and coiled along that price support zone. Many times this would present itself with a drop into something such as $17.82 and then the next test of the $18 support within the coil would hit $17.96, followed by a third move which tests the $18 exactly and holds, often forming a smaller congestion base at that exact price before breaking on that third test. Today PDLI reversed back into that price level and hence it served as resistance. The highs of the day were $18.12 with a closing price of $17.87. Both were well within the $18 price resistance "zone."

The second type of price support/resistance that I wish to cover is closely tied to the first. It deals with retests of previous pivot highs or lows. A "pivot" is simply a level where prices reverse. You can usually identify them by the "V" or upside down "V" that they form. You may not see them unless you drop down to smaller time frames if the security is in a congestion. Sometimes these price pivots correspond to whole number s/r, sometimes they do not.

FIGURE 4 - $DJI Daily

In this example of the Dow, it does correspond to the whole number support/resistance levels (Figure 4). We are looking first at the 14,000 level. This hit in July for the first time and then retraced back into the prices from the first quarter. When the Dow hit the 14,000 zone for the second time, it was actually at the end of September that this took place, coming off a sharp rally mid-month.

The "zone" of the 14,000 high was where all the price bars overlapped at the initial 14,000 highs. The stronger upside momentum on the second test of the 14,000 resistance level allowed the Dow to push somewhat past the exact high to form a slightly higher high before the momentum reversed and led the index back into the previous lows. The August lows were made on extreme downside momentum. Since the pace was slower into November on that second retracement off the 14,000 highs, it did not quite hit the exact lows from August, but only came into the support "zone" of those lows.

FIGURE 5 - JBLU Daily

Another example was the $10 level I had mentioned earlier in JBLU (Figure 5). You can see that while $10 hit and held on the first day into that level in April. It then rolled over a bit off the lows, like the Dow did off the second highs, and made somewhat lower lows. It did not quite hit that $10 support the second time around, although it did retest the "zone" of that support in June.

Whole number support/resistance can also be tied into the third type of price support/resistance: congestion zones. When a security falls into a trading range, congestion zone, base, coil, or whatever you wish to call it, that zone becomes s/r on any retracement once it has broken. A breakout to the upside from a trading range will mean that the range itself becomes support on any retest of it. These trading ranges often take place around whole numbers.

FIGURE 6 - $DJI Daily

As in the other types of s/r, the stronger the congestion is retested, the more the security can penetrate that s/r zone. A more shallow move into the congestion after it breaks lower and is moving higher, such as in "A" in Figure 6, can mean that the lower end of the range tests and holds first like it did a few weeks before "A".

A stronger move, such as into "1" on a pullback off highs on an upside breakout, can lead it to testing the lower end of the channel before it sees much reaction. In #2 it also pulls into the lower half of the earlier congestion, which also corresponds to the 13,400 whole number support and the pivot high in "B". In this case, #2 has all three types of price support we have covered thus far interacting at the same time, making it a very substantial support level!

Another example of this type of s/r also took place on the chart of JBLU (Figure 7). Not only was the July test of $12 a return to the whole number as price resistance, but it was also resistance from that earlier congestion level.

FIGURE 8 - PDLI Daily

PDLI has two examples (Figure 8). The first is a larger congestion back in September and the second is just a three day congestion in mid-October. Since the price drop into the larger congestion was very rapid, it pulled to the lower end of it in the second half of Oct., while the smaller congestion served as resistance on the bounce off the Oct. lows.

The final type of price support or resistance that I will show you today is an equal or measured move. You can call them whichever you wish :) This concept is rooted in momentum as well. Essentially, if a price move is followed by a congestion, such as a base, flag, etc., then as long as the congestion breaks at about the same momentum as the move into it, it will have the strong potential to hit an equal move level on that continuation.

FIGURE 9 - JBLU Daily JBLU has two such

examples on this

daily chart (Figure 9). Obviously you can combine this with the other

types of s/r to help establish targets, even if something is at new

all-time highs!

FIGURE 10 - PDLI Daily

JBLU has two such

examples on this

daily chart (Figure 9). Obviously you can combine this with the other

types of s/r to help establish targets, even if something is at new

all-time highs!

FIGURE 10 - PDLI Daily

PDLI (Figure 10) also had this take place when the correction off the Oct. lows gave way and the new congestion zone into November broke lower at the same rate of selling as it had seen heading into that congestion level. It was unable to mimic the move for a third time, however, due to a much more substantial support level from the lows in 2006. This was the first time that larger support zone had been retested, so it was unable to easily break through it.

Smaller time frame support or resistance levels will always be easier to bust than those on a larger time frame, even though the zones on the larger time frames will be wider. At the same time, support or resistance levels which have most of these types of support or resistance hitting at about the same time will also be stronger than if only one of these 4 hits at any given time. Since the prices of each will not tend to line up exactly, this is another reason you must consider them to be ZONES and NOT EXACT PRICES!!!!

In my class on December 20th, I will pick up on the topic of support and resistance by examining trends and channel support and resistance and how to best utilize those in combination with the 4 types we have already covered today. Thank you guys for coming! I have now unmoderated the room, so please feel free to post any questions you may have.

speculatormike: Very helpful, thank you Toni

Sunrise: thanks Toni - good stuff, nice review!

chastain: Thanks Toni. Very good info.

Helena1045: Thank you!

trauma: thanks Toni

Toni: You're welcome!

lhb: Toni, if a support level is broken, thereby becoming Resistance, and later on, if that resistance is broken, do you then discard that area as a s/r level since we have traded below and above it?

Toni: Typically I will then back up a time frame, see if I still notice any sharp pivot level or such at that point. The closer the price is to a previous level, the stronger it is. So, the further away it is in time, the more likely I will be to look at more recent levels.

ymtrader: Something I'm interested in is deciding when a resistance has been broken definitely. I was nailed once today on YM at pivot R2 where I shorted @ R2 as it completely looked like it was reversing, then it shot through resistance. So far in my world it's just "one of those things that can happen"...Curious on ways to alleviate that other than tight stops (which I had).

Toni: This is where other building blocks for price development becomes very important. Things like momentum, volume, trend placement, etc. will help you eliminate or significantly reduce this error.

ymtrader: Gotchya, thanks. All things I sort of know are important but haven't studied enough.

lhb: Which of the different type of s/r is the strongest ?

Toni: I do not think one is any stronger than the other by itself. When they are combined, they become more powerful. So, one alone would be considered weaker than two or three.

ShootingStarr54: When using a pivot calculator How important is it to include the open price vs just the previous day HLC?

Toni: This is an interesting question because I have not used a pivot calculator in about 7+ years... :) The thing is, people use several ways to enter their data into them, so even with that, I would not rely solely on the calculator and instead combine it with these other forms. Gaps are something I did not talk about today, but opening and closing gap prices are a 5th form of price s/r.

lhb: ss54, standard floor pivots only use the prior day HLC, so open is not relevant.

ShootingStarr54: thanks Toni & ihb

joaohgomes: Toni, when do you consider zone of support or resistance no longer valid as reference point?

Toni: This essentially goes back to my previous answer... If I am daytrading futures, I tend to only use the prior day for the smaller s/r levels and then keep back off to larger time frames. For instance, heading into the upcoming session, the 5 min highs and lows in the current session will be strong s/r to watch for on most days. A week later, however, the highs and lows on a 15 or 30 min chart become more important.

speculatormike: Is this material on your CD-ROM course?

Toni: Yes, the course is about 7 hours covering each of the 5 building blocks I use for analyzing price development. The 5 are the support/resistance, volume, trend development/trend placement, momentum, and correction periods.

lhb: On the mini futures, shouldn't one be aware of whole number support on the cash index as well? For example, if Dow is near 13,000 I was wondering if the reverse is true, i.e. if futures are near whole number will it affect cash index generally.... Seems like a lot to be aware of...

Toni: Yes, that is helpful, but I admit that I personally don't look at it :)

ymtrader: This is true, I was wondering that today... when the cash index is flirting around a round number and the futures are not

lhb: ok, thanks

joaohgomes: Toni, I'll try to rephrase my question: suppose a resistance is overcome an than become support, what event must happen so you will not consider these zones as valid support/resistance?

Toni: One instance would be let's say that the resistance is the $100 level it breaks higher but the momentum on the breakout is rather weak and it barely pushes to new highs maybe $101 then it can turn with such sharp momentum that it breaks back past the $100 level very quickly, maybe only stalling for a minute before dropping under the congestion.

lhb: $100 is probably bad example, because that is always going to be whole number s/r.

Toni: Well hence the minute stall :) A similar concept can be used on breakouts to new highs. If a security rallies to $100 then pulls back but it pulls back very slowly puts in new highs at like $99.70 or something. Then when it breaks that $99.70, if the $100 level is relatively close, it can push through it very quickly without really correcting again for much time at all. This is something that catches people off guard... They buy a bull flag, for instance, and assume the previous high at the start of the flag will be strong resistance. If the flag still formed within the upper 1/4 or so of the previous upside move into the flag, however, it might not stall at all at the previous high, yet people still tend to use it as a target and get worried about it when they shouldn't.

ShootingStarr54: Would you be more aggressive taking a trade based on the futures being up or down?

Toni: Yes, if you mean a setup occurring which corresponds to favor from the futures market. A lot of momentum and news stocks I will play will less regard to the futures market.

unocapricorn: I f you are trading the SPY would you base you actual entry & exit by SPY or how much should SPX influence it?

Toni: When this question comes up, I am often dealing with people who wish to start trading futures for better tax and leverage reasons, so they should definitely take their triggers based upon the futures market. For just ETF traders though, then I like using the indices themselves to just show clearer price action. SPX, COMPX, DJI etc

joaohgomes: http://i5.tinypic.com/6qbmqf4.gif will you consider this level as resistance?

Toni: correct :)

joaohgomes: ok... tks

Toni: Ok gang, I have to get going to feed my kids before they organize a revolt :)

lhb: thanks, Toni

Toni: Thanks again for coming today!

onewrite: Thanks Toni

Biegs: thanks toni!

Toni: you're welcome!

unocapricorn: thanks Toni

Toni: I'll see you guys on the 20th! 4:15 ET

jmb: Thanks Toni

thomas175: thanks Toni

Toni: You're welcome!

kdx8: thanks

joaohgomes: thank you Toni ... enjoyed the presentation

joaohgomes: gn all

Click here to view the logs to Part 2.

Testimonials for Toni Hansen

"Dear Toni, I want to thank you for sharing the knowledge and insights you have gained over the years as a professional trader. I would recommend your CD and mentoring to anyone serious about consistently making money in the market, regardless of market conditions. As an experienced investor who has watched you firsthand, it is clear that you are a world class trader. Thanks for helping me become a better trader." - Guy Allen, Florida

“I owe you so much when it comes to my development as a trader. You have been a guiding light... I will always look back on you as a key element in that success. Thank you so very much...” - Greg

“Anyone who is trading needs your guidance for the education of trading. Your education of trading aspects is the GREATEST thing I have ever used. I learned more in two weeks from you, than from any books I read. THANKS AGAIN!” - Clarence E. Austin

“I'm done for the day and am very pleased...I have taken all your calls and follow them to the T...the NQ ones that is (trade QQQQ) and I play the gaps in the morning also (I'll take the 71% chance anytime)...I have turned myself around...First time in months...Thank-you! ”- Richard Widen

“I hope that everyone truly understands just how fundamentally sound and accurate your market trading strategies and concepts are. I have been trading for quite some time, and I just want you to know that I have been so very impressed with your substance based upon sound trading fundamentals and not "fluff" THANK YOU...” - Randall Morrow